Beyond competitor intelligence: Strategic interpretation is the real edge

In a world drowning in competitive data, the challenge isn’t access—it’s insight. Cognosis partner Olivia Buckle-Wright explains the importance of competitor intelligence vs competitor insights and how businesses can cut through the noise - finding the right trees within the forest of data.

In an age of AI-powered data abundance, true competitor intelligence & understanding lies not in what you know, but in how you think about what you know and what information you choose to act on.

The Illusion of Competitive Clarity

We're living through an unprecedented age of data abundance – and intelligence dilution. Information about competitors is everywhere and relatively freely accessible. Social media activity, patent filings, job postings, earnings calls, regulatory submissions – it's never been easier to gather competitor intelligence.

But here's the paradox: It's equally never been harder to cut through the noise.

This democratisation of competitive intelligence has effectively flattened the playing field. Big tech giants, venture-backed startups, and established SMEs all access substantially the same information. Open-source intelligence tools and AI-powered analytics have levelled access to competitive data in ways unimaginable just a decade ago.

The barrier is no longer access – it's interpretation. The aim of the game has changed from investigation to interpretation. Competitive advantage no longer lies in owning the data; it stems from creating meaningful insight. Lengthy reports filled with facts and figures may look impressive; but do they have the substance to guide high-stake decisions?

> RELATED GUIDE: Develop winning stategies that keep you ahead of competitor disruption

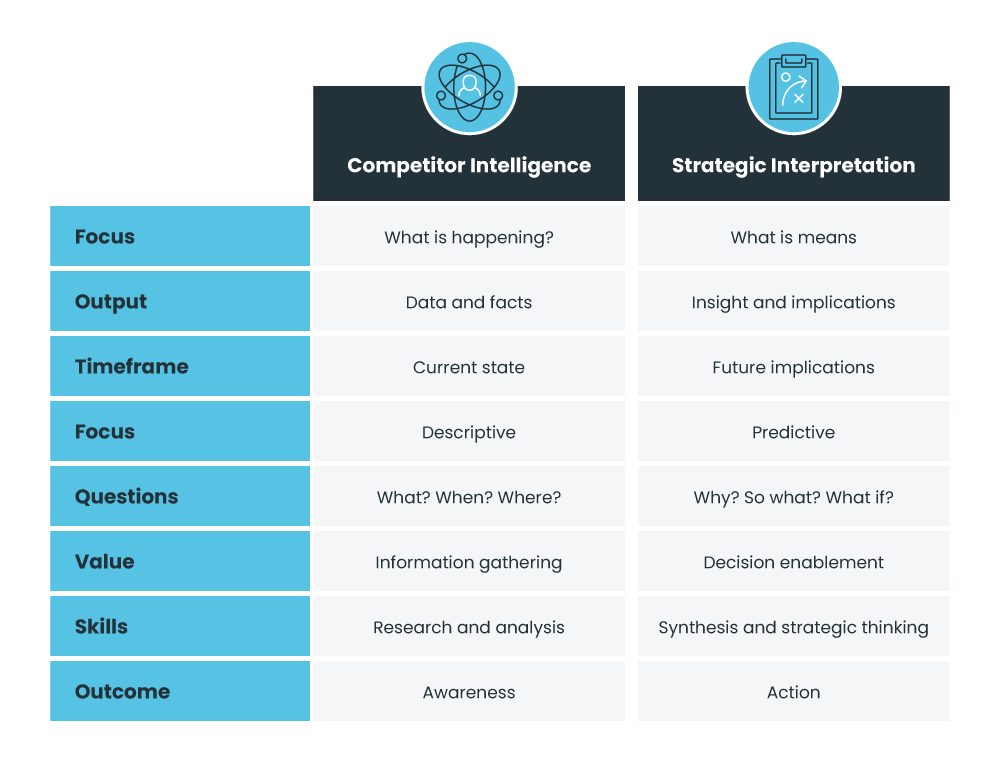

Intelligence vs Insight: Two Distinct Disciplines

Understanding this difference is the starting point for turning data into real impact.

Competitor Intelligence is the systematic gathering of raw facts from external sources.

It's the what: competitor revenues, product launches, hiring patterns, marketing campaigns, strategic announcements. Intelligence is comprehensive, factual, and increasingly commoditised.

Strategic Interpretation is the process of synthesising, contextualising, and connecting that intelligence to business objectives.

It's the so what: understanding why competitors are making specific moves, what those moves reveal about future market direction, and how your organisation should respond strategically.

The gap between intelligence and insight is the new competitive battleground.

From Data Collection to Meaning Creation

A strategic interpretation viewpoint prompts you to look deeper into the data for patterns that can inform future opportunities and risks. In our experience, it’s a valuable aid for separating genuine market momentum from background noise. When multiple competitors simultaneously invest in similar capabilities, it can indicate structural market shifts. Competitor decisions may also telegraph future market conditions or regulatory changes, providing early warning systems for strategic planning.

But, as in chess, not every move signals strategic intent. When isolated players make dramatic pivots, they might indicate desperation rather than opportunity. Strategic interpretation therefore distinguishes between market actions that are noteworthy and those that are distracting.

The most valuable competitive intelligence reveals future market positioning rather than current tactics. Let’s say a long-standing competitor launches a new service offer. Is this move an offensive play toward emerging opportunities – or a defensive reaction to existential threats?

Making a distinction will help determine your own strategic response whether to match, outflank or ignore. When direct competition is unnecessary or even counterproductive, you can allocate resources toward more valuable opportunities.

Look at market intelligence through different lenses

Understanding how competitive moves mayaffect customer behaviour, needs and expectations can reveal market gaps and positioning opportunities that pure competitor analysis might miss. Of course, any practice that compels you to see the market through your customers’ eyes is always worthwhile.

Strategic interpretation succeeds through disciplined inquiry, rather than accepting competitor intelligence at face value. A useful question to ask is: what would we have done differently if we knew this six months earlier? This retrospective analysis builds organisational capability for faster strategic response and better anticipation of competitive dynamics.

Get creative in strategic sessions. Think outside the usual parameters. What would you do in your competitors’ shoes? How do their individual decision makers view the market? Wear their name badge for an hour. This perspective shift may feel uncomfortable, but it’s crucial for combating cognitive biases. Effective strategic interpretation requires seeing competitor moves through their lens – their culture, constraints, capabilities and strategic context – rather than projecting your own organisational perspective onto their actions.

From Awareness to Action: 6 Ways to Build Strategic Interpretation Capability

Transforming competitor intelligence into strategic advantage requires systematic approaches. We use the following strategic approaches and frameworks to reveal meaningful, actionable insight:

- War Gaming and Scenario Planning: Regular war gaming exercises evaluate strategic assumptions against competitor behaviour patterns. Rapid scenario planning helps teams explore multiple competitive futures and prepare response strategies before situations crystallise.

- Battle Ground Mapping: Find where competitive battles will be fought – rather than where they're currently being fought. This involves mapping competitor capabilities, intentions, and constraints against emerging market opportunities to enable proactive positioning.

- Strategic Playbooks: Codify your response to specific competitive scenarios to accelerate decision-making when intelligence reveals strategic threats or opportunities. These playbooks connect intelligence patterns to predetermined strategic responses. You’re ahead of the game and ready to act. (This exercise may also make the case to move before your competitor.)

- Cross-Functional Teams: Strategic interpretation requires diverse perspectives. Crucially, commercial teams – those closest to customers and markets – bring invaluable interpretative perspective. But don't overlook other functions that regularly interact with competitors, such as HR and Corporate Affairs. Regular sessions with cross-functional teams will often reveal strategic insights that pure desk research misses.

- Joining the Dots: Organisations serious about strategic interpretation must invest in building the right internal capabilities. This includes a cultural shift from information gathering to insight creation, rewarding interpretative quality over data volume. Likewise, decision integration is important to ensure competitive insights directly inform strategic planning, resource allocation and operational decisions.

- Beyond The Company Walls: External partnerships help recognise when strategic interpretation requires specialised expertise or simply a different perspective to avoid internal blind spots. Do you have people who can see patterns across disparate data points and connect competitor moves to broader market trends? Are you able to strategically facilitate a discussion that moves beyond interpretation of the intelligence into impactful strategic choices? You may need to build this capability internally or benefit from external support.

The Strategic Imperative: from bottleneck to catalyst

In markets where information is abundant, but insight is scarce, strategic interpretation becomes the ultimate competitive advantage. Companies that master this capability won't just respond to competitive threats – they'll anticipate them. They won't just match competitor moves – they'll make the moves that force competitors to respond.

The question isn't whether your organisation has enough competitor intelligence. The question is whether you have the interpretative capability to transform that intelligence into strategic foresight.

The data is the same for everyone. The difference lies in what you do with it.