Strategic focus in dynamic markets: Choosing where to win

UK businesses are navigating an increasingly complex landscape. The dynamic market conditions demand different strategic priorities and failing to recalibrate your strategic focus as conditions evolve will mean missing opportunities, misallocating resources, and risking irrelevance.

Strategy development is fundamentally about making choices. It's deciding where to play and, crucially, where not to play. But as market conditions shift, so too should your strategic focus.

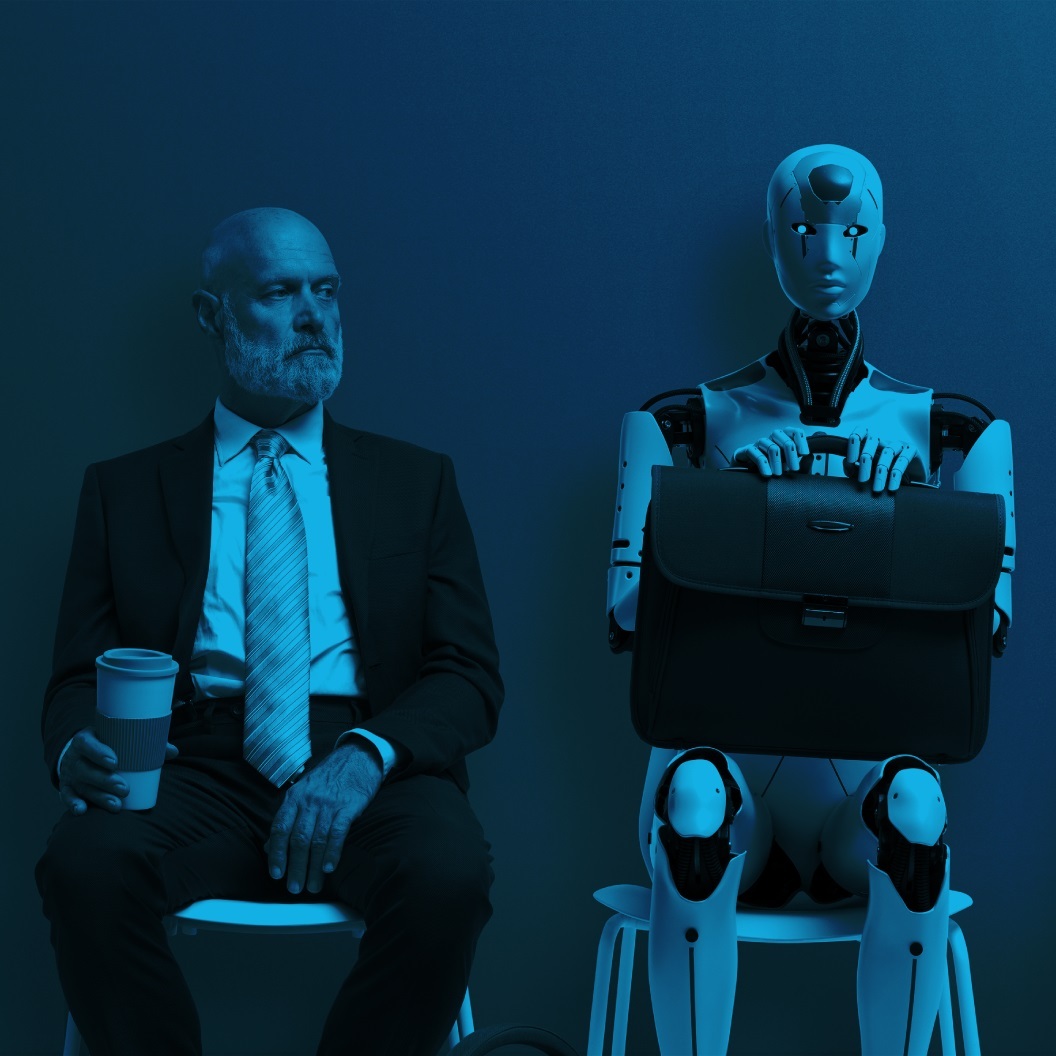

In 2025, UK businesses are navigating an increasingly complex landscape: inflationary pressure remains persistent, AI adoption is reshaping operating models, supply chain fragility continues post-Brexit, all amid unprecedented levels of geopolitical instability. The playing field isn’t just moving; it’s being redrawn.

Many organisations, however, continue to apply the same strategic lens regardless of their competitive environment. This is a mistake. Different market conditions demand different strategic priorities. Sticking with yesterday’s strategic focus in today’s conditions not only wastes resources - it actively blunts competitiveness. As the rules of the game evolve, the winners will be those who not only see the change but are willing to reframe where (and how) they choose to compete.

> RELATED ARTICLE: Leadership pitfalls to avoid when scaling a business

Overcoming the challenge: Adapting your strategic focus

Effective strategy requires a comprehensive examination of your business across multiple dimensions - from customer needs to competitive positioning, operational capabilities to financial constraints.

While many leadership teams have mastered the analytical aspects of strategy development, they often struggle to adapt their focus as market conditions evolve. The frameworks that served them well in one context may become liabilities in another.

As Peter Drucker famously noted, "The essence of strategy is choosing what not to do."

This wisdom remains as relevant today as when it was first shared. The challenge is knowing which choices matter most in your specific market context.

A dynamic market framework for strategic focus

We've identified two critical factors that should determine where you focus your strategic energy:

- Market growth rate: How fast is the overall market expanding?

- Market fragmentation: How concentrated is market share among competitors?

These two dimensions create four distinct strategic environments, each requiring a different primary focus:

Four market conditions, four strategic imperatives

1. Low Growth, Low Fragmentation: Win through competitive advantage

When markets mature and consolidate, the battle shifts to securing sustainable competitive advantages. This is the reality for many established sectors where growth is limited and a few major players dominate.

Strategic imperative: Develop defensible advantages in cost structure, customer loyalty, or operational excellence.

In these environments, strategic priorities include:

- Relentless operational efficiency

- Deep customer retention and loyalty initiatives

- Targeted M&A to consolidate further

Real-world example: The UK grocery retail sector, where approaches like Tesco's Clubcard data insights and competitive pricing strategies have enabled sustained market leadership despite intense price competition and margin pressure.

2. High Growth, Low Fragmentation: Create formidable barriers

High-growth markets with few competitors create a different challenge: protecting your position while the prize is still growing. These markets often have significant barriers to entry already, but reinforcing them becomes crucial.

Strategic imperative: Build barriers that make it increasingly difficult for new entrants to challenge your position as the market expands.

Key focus areas include:

- Intellectual property protection

- Network effect reinforcement

- Strategic control of critical resources or distribution channels

Real-world example: UK mobile telecommunications in the early 2000s, when companies like Vodafone invested heavily in infrastructure and exclusive partnerships to maintain dominance during rapid market expansion.

3. Low Growth, High Fragmentation: Win Consumer Preference

Crowded markets with limited growth create intense competition for consumer attention and loyalty. When many players are fighting for a static pie, winning consumer preference becomes the key battleground.

Strategic imperative: Create genuine differentiation through brand building, exceptional customer experience, or niche specialisation.

Strategic priorities should include:

- Brand differentiation with emotional resonance

- Customer experience excellence at every touchpoint

- Deep specialisation in valuable niches

Real-world example: The UK independent coffee and café sector, where operators like Gail's Bakery have achieved premium positioning and customer loyalty through artisanal quality and community connection, commanding higher margins in an otherwise commoditised market.

4. High Growth, High Fragmentation: Drive Relentless Innovation

Fast-growing environments with many competitors create a dynamic market where yesterday's innovation quickly becomes today's standard. These markets are often in flux, with new entrants continuously challenging established players.

Strategic imperative: Establish a relentless innovation engine that can continuously identify and capture emerging opportunities.

Focus areas should include:

- Rapid experimentation and learning systems

- First-mover advantages in emerging segments

- Flexible partnerships and platform development

Real-world example: The UK fintech sector, where companies like Revolut and Monzo drive continuous product innovation and rapid iteration to capture share in a high-growth, fragmented market where the rules are still being written.

While The Strategic Focus Matrix provides valuable guidance on primary focus areas, it complements rather than replaces comprehensive strategic analysis. Organisations must still consider:

- Core capabilities and competencies

- Regulatory and technological trends

- Capital allocation and financial strategy

- Organisational culture and leadership alignment

The real power of this framework lies in helping leadership teams adjust their emphasis as market conditions evolve, ensuring strategic approaches remain dynamic and responsive.

Three questions for your leadership team:

- Which quadrant best represents the market we’re operating in today - and how confident are we in that assessment?

- Does our current strategic focus reflect the realities of that market - or are we still playing by outdated rules?

- How are we preparing for shifts in our market over the next 3–5 years, and what strategic pivots might we need to make now to stay ahead?

The most successful organisations don't just develop smart strategies for current conditions - they continually challenge their assumptions and adapt to change with clarity and intent. In dynamic, often unpredictable markets, standing still is rarely neutral. Failing to recalibrate your strategic focus as conditions evolve means missing opportunities, misallocating resources, and risking irrelevance.

That's the difference between short-term performance and enduring market leadership: Not just having a strategy, but actively managing it - deliberately, decisively, and continuously.